Southeast Asia: FinTech as a Catalyst to Growth

- Dec 15, 2025

- 5 min read

The solution to Southeast Asia’s growth paradox (as outlined in our previous article, “The Middle-Income Trap”) may lie in its most dynamic sector: FinTech. With one of the world’s fastest-growing digital populations and a rapidly expanding middle class, the region is ripe with opportunity. However, persistent financial exclusion is creating roadblocks. Millions of individuals and small enterprises remain locked out of the formal financial system, unable to access the credit and services they need to thrive. With the right combination of innovation and capital, FinTech can bridge these gaps, turning untapped potential into widespread prosperity.

Financial Inclusion to Achieve Accelerated Growth

Southeast Asia is home to more than 8% of the global population, yet 85% of adults are underbanked, while 24% remain unbanked (1).

According to a Tech for Good Institute survey, 60% of regional micro, small, and medium enterprises (MSMEs) seeking financing or credit reported encountering major hurdles or complete denials when applying for loans through conventional financial institutions (2).

A 2022 research paper looking at the challenges ASEAN SMEs face in trade finance reveals several additional interesting facts:

APAC has the highest proposal rate (40% of global proposals) and highest rejection rate (34% of global rejections) for trade finance among developing regions.

While SMEs generate the highest number of proposals (44%), their rejection rate, at 56%, is higher than their proposal share. To put that into context, the rejection rate of multinational corporations is 10%, while large corporations are rejected at a rate of 34%.

35% of surveyed SMEs reported rejection due to failure to meet standard requirements like collateral, documentation, and valid company records.

For SMEs in developing economies, potential lost revenue from global trade due to financing difficulties can be as high as 50% (3).

The region faces a $2.5 trillion credit access gap that makes up over half of the global shortfall in small business financing. Traditional banks, constrained by legacy systems and risk-averse models, struggle to serve these segments efficiently. According to MasterCard, another major factor is that SME financing is simply too expensive (4).

The solution to these issues, may be found in the rapidly expanding industry of FinTech.

By leveraging alternative data, mobile identity verification, and real-time credit scoring, FinTech firms are able to assess risk and extend microloans to individuals and small businesses considered “un-bankable” by the limitations of standard credit-scoring (5).

Embedded finance—where financial services are seamlessly integrated into non-financial platforms like ride-hailing or retail—brings loans, insurance, and payments to millions who might never walk into a bank branch (6).

Digital lenders, neobanks, and embedded finance platforms are turning financial inclusion into a business strategy. One example is Singapore’s Anext Bank, who are redefining SME financing with their universal pricing scheme. The bank utilizes advanced data analytics, automated risk assessment and embedded banking to deliver fast, accessible financing to younger, less developed businesses (7).

The outcome is a powerful ecosystem that turns inclusion into innovation.

Strategic Investing with Venture Capital

In developed markets, financial innovation often evolves incrementally. However, with Southeast Asia’s young, digitally-savvy population, its high mobile penetration, and supportive governments who facilitate greater domestic and cross-border digital payments adoption (8), FinTechs are skipping over legacy infrastructure entirely.

Digital banking licenses are proliferating within the region, being seen by regulators as a solution to the limitations of bogged-down legacy banks (9). Many of these digital banks operate with mobile-first models that serve millions of customers at a fraction of traditional banking costs (10). AI-driven analytics and cloud-native architectures are creating opportunities to deliver instant credit decisions, real-time payments, and personalized financial advice at scale (11).

While venture funding may have cooled globally since its 2021 peak, Southeast Asia’s FinTech sector remains one of the most underpenetrated yet promising markets in the world.

The first 9 months of 2025 have seen the investment landscape tighten sharply, with deal activity dropping 60% year-on-year to just 53 transactions, and total funding falling 36%. This year, capital allocation has shifted decisively toward late-stage deals, with average late-stage cheque sizes jumping 40% to US$112 million. This suggests that investors are gravitating toward companies with validated economics and a clear path to scale (12).

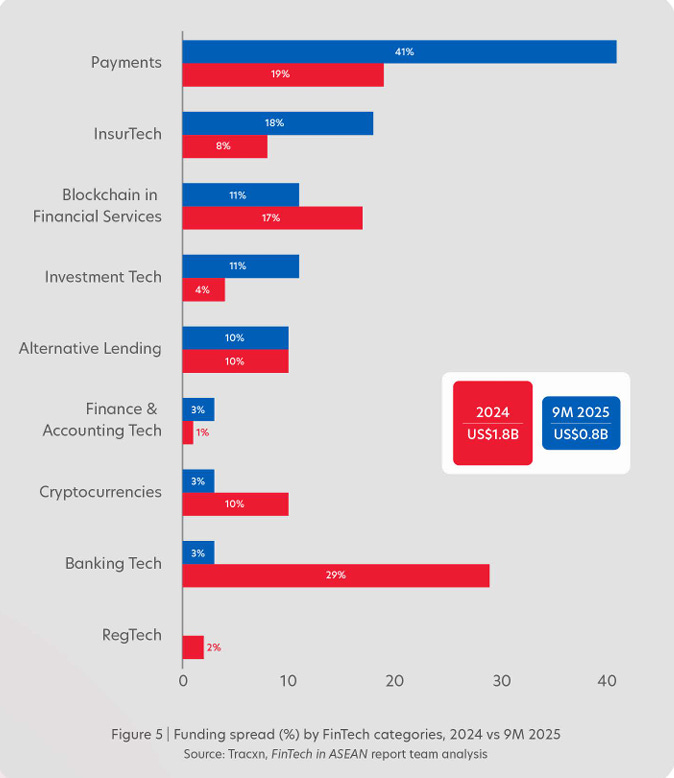

Payments reclaimed its position as the most funded category, buoyed by ASEAN’s rapid adoption of interoperable QR systems, real-time settlement, and cross-border payment rails. InsurTech followed, driven primarily by a US$147 million investment into Singapore’s Bolttech. Meanwhile, Blockchain funding contracted as capital rotated toward regulated, infrastructure-focused models supporting real-world applications like cross-border transfers.

By deal count, Investment Tech and Payments led with eleven deals each, followed by Alternative Lending with ten. Notably, Alternative Lending has remained Indonesia’s most supported FinTech segment for three consecutive years (13). Currently, ASEAN-6 boasts 14 out of greater Asia’s 54 FinTech unicorns. The majority of these companies are in the Payments category, followed by Alternative Lending (14).

It may be interesting to note, that Silverhorn is actively involved in at least 2 (Welab and Akulaku) of the Asian unicorns.

Across the region, FinTechs which utilize AI through practical, targeted integration are emerging as the next catalyst in the ASEAN FinTech evolution. Use cases include improving automation, decision-making, and fraud detection.

Conclusion

The region’s next leap won’t come solely from infrastructure or consumption, but from empowering its people and enterprises to participate fully in the digital economy. Fintech stands at the heart of that transformation. With data-driven innovation, mobile accessibility, and supportive investment, FinTech can close credit gaps, formalize MSMEs, and create pathways for millions to achieve financial security.

FinTechs represent both a growth and impact opportunity for investors, while those that address core financial pain points are positioned to become the next generation of unicorns. Strategically deployed institutional capital can help these companies to scale responsibly and expand across markets.

As global investors look for resilient, high-impact opportunities, Southeast Asia’s FinTech ecosystem offers a rare alignment of purpose and profit. The path from credit gaps to unicorns is not merely a story of funding startups; it’s the story of a region ready to redefine its economic future.

References:

Financial Inclusion ASEAN Deepens Through Fintech Innovations

Realizing the Potential of Over 71 Million MSMEs in Southeast Asia

Driving Financial Inclusion in Indonesia with Innovative Credit Scoring

The flat-pricing revolution for inclusive SME finance in Asia

[Bridging ASEAN through regional payment connectivity](https://www.uobgroup.com/techecosystem/insights/regional-payment-connectivity.page?)

Southeast Asia’s Mobile-First Fintech Surge — Super Apps and Digital Transformation

Beyond the code: How mobile banking is weaving a new financial narrative in Asia

Southeast Asia’s unicorns in 2025 show a new startup reality

Comments