July Insight | Monthly Macro Overview

- Aug 4, 2025

- 2 min read

Overview:

In May, leading financial institutions, including Goldman Sachs, JP Morgan, and Morgan Stanley, raised their forecasts for China's GDP growth in 2025 due to pro-growth policies. Goldman Sachs increased its forecast to 4.6% from 4%, citing improved export growth and net exports. JP Morgan revised its forecast to 4.8% from 4.1%, attributing the change to proactive fiscal policies. Morgan Stanley raised its forecast to 4.5%, citing improved consumption and AI advancements, and Nomura raised its forecast to 4.5% from 4%, highlighting robust retail sales and easing trade tensions. Other institutions like Standard Chartered and UBS also noted China's economic resilience and supportive policies. Nevertheless, underlying concerns remain. Domestic production continues to outpace demand, inventory pressures for property developers persist, and the real estate market's stabilization outlook remains unclear. Additionally, the stimulus effect of trade-in programs for durable goods may diminish over time. To address these challenges and ensure sustained economic recovery, the government has ample macro-policy reserves and plans to introduce additional policies to expand domestic demand.

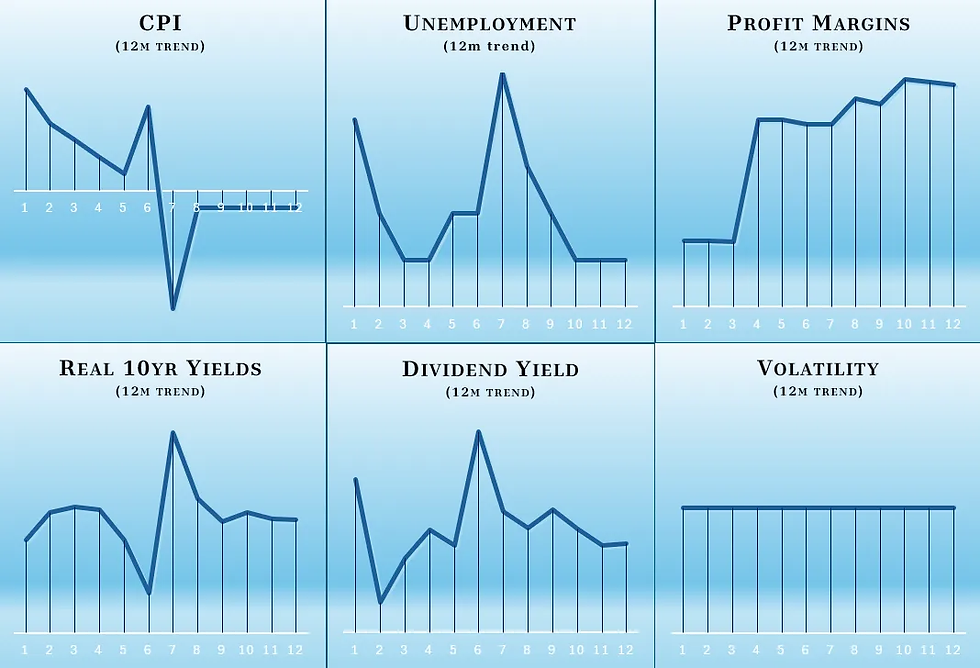

Macroeconomic Indicators July:

China's inflation rates are holding steady at their 12-month mid-range. Unemployment levels have dropped further, while profit margins continue to climb. Bond and dividend yields are also holding steady at the 12-month mid-range.

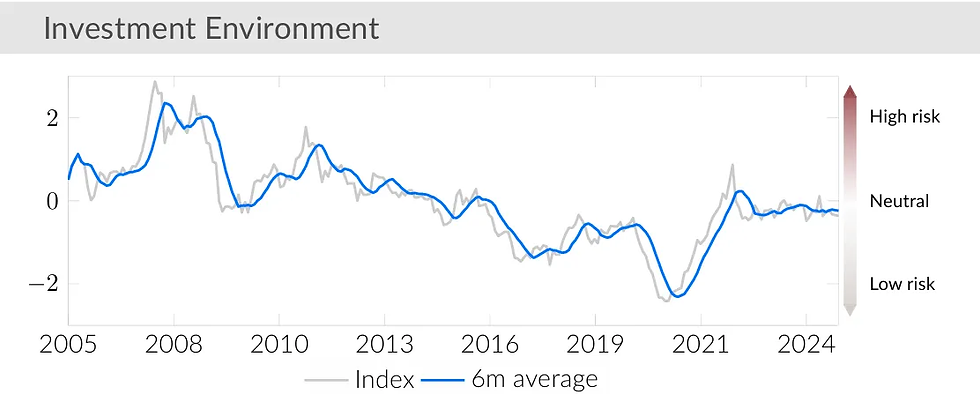

The Business Cycle, Investment Environment, and Market Behaviour are all hovering around neutral risk giving an overall market risk signal of neutrally aggressive.

July Highlights:

From January to May, China's investment in fixed assets, excluding rural households, reached over 19 billion yuan or about 2.6 billion USD. This number is up 3.7% YoY, with non-governmental investment remaining flat. MoM, fixed asset investment rose by 0.05% in May. By industry, primary sector investment increased by 8.4%, secondary sector by 11.4%, and tertiary sector decreased by 0.4%. Notably, industrial investment within the secondary sector grew by 11.6%, with significant increases in mining (5.8%), manufacturing (8.5%), and utilities (25.4%). In the tertiary sector, infrastructure investment rose by 5.6%, with substantial gains in waterway transport (27.2%) and water conservancy (26.6%).

China's FDI landscape in early 2025 presents a mixed picture. While the country saw a 12.1% increase in new foreign-invested enterprises, reflecting confidence in its market and business regulations, total foreign capital usage dropped by 10.9% year-on-year due to global economic uncertainty. The services sector attracted the majority of inflows, with high-tech industries like e-commerce, aerospace, and pharmaceuticals experiencing significant growth. Investment sources showed varied trends, with notable increases from Japan, Switzerland, and the UK. However, European firms exhibited caution, with only a small percentage considering China a top investment destination. China is responding with efforts to stabilize FDI through expanded market access, policy upgrades, and institutional reforms, aiming to boost investor confidence and guide capital toward strategic sectors.

Global STEM education leadership has shifted from the US and Europe to Asia, with China, India, South Korea, and Japan emerging as key players. Other countries making notable strides are Brazil and Mexico with the number of graduates between 2015-2020 growing by 26% and 30%, respectively. A higher number of STEM graduates can be a good indicator of future economic growth. China’s high percentage of STEM graduates out of their total graduate pool suggests why they are rapidly closing the gap with the US in GPU technology and AI development.

Comments