China’s Vision to Shape Global Governance and Attract Capitals

- etao948

- Dec 15, 2025

- 3 min read

Xi’s speeches outline China’s global vision

In two major speeches delivered early September, Chinese President Xi Jinping outlined his vision for global governance and China’s role in shaping the international order.

Speaking at the SCO Plus meeting, Xi outlined several points toward achieving a proposal he called the “Global Governance Initiative”.

An indication that he would take the lead on this initiative came with his statement:

…I wish to propose the Global Governance Initiative (GGI). I look forward to working with all countries for a more just and equitable global governance system and advancing toward a community with a shared future for humanity.

The idea put forth for GGI is rooted in sovereign equality and a people-centered approach to “ensure that the people of every nation are the actors in and beneficiaries of global governance”. He advocated for adherence to international law via strengthening the role of the UN, and that this should come with greater representation from developing nations.

Xi also expressed China’s commitment to deepening cooperation with SCO members by expanding trade, technology, and sustainable development initiatives. Over the next five years, China plans to increase photovoltaic and wind power capacity by 10 million kilowatts. He also proposed joint efforts in AI, encouraged wider use of the Beidou Satellite Navigation System, and invited participation in the International Lunar Research Station project.

At the Beijing ceremony, which marked the 80th anniversary of the end of World War II, Xi urged nations to choose cooperation over confrontation. He reiterated China’s commitment to peaceful development while also stressing his vision to “speed up the building of a world-class military” to safeguard China’s sovereignty (1).

Initiatives to drive foreign investments

Earlier this year, China unveiled a comprehensive action plan to stabilize and expand foreign investment. Invest in China, which is both a government initiative and a developing brand (2), comes amid a global shift in investment outlooks, and seeks to fill the gap for international investors.

The plan introduces 20 key measures aimed at making China a more attractive destination for foreign capital. These include removing restrictions on foreign investment and the use of domestic loans, facilitating mergers and acquisitions, broadening market access in key sectors, and encouraging foreign participation in high-tech industries (3).

However, there are still challenges ahead in getting international investors on board. According to China’s Ministry of Commerce, foreign direct investment continues to fall, albeit at a slower pace. In August FDI fell 12.7% YoY, a slight improvement from July’s 13.4% decline. Nevertheless, high-tech industries drew CNY 148 billion, demonstrating that foreign interest is there, even if overall inflows have slowed. Sectors with standout growth include e-commerce (169.2%), aerospace manufacturing (37.5%), and pharmaceuticals (23.2%). Primary foreign investment came from Japan, Switzerland, and the UK (4).

On the equities front, foreign investors are cautiously returning after years of retreat, drawn by advances in AI, semiconductors, and biotech (5). Investors are increasingly seeing China as a valid diversification from US-based assets thanks to policy changes which have expanded access to its equities and derivatives markets, while preparing a robust pipeline of new product launches that are crucial to its green transition and sustainable development initiatives (6).

Since the beginning of 2025, the Shanghai Stoch Exchange recorded a 20% increase. While early movers and hedge funds are increasing their allocations, broader inflows have yet to take off, suggesting that Chinese equities are still competitively priced.

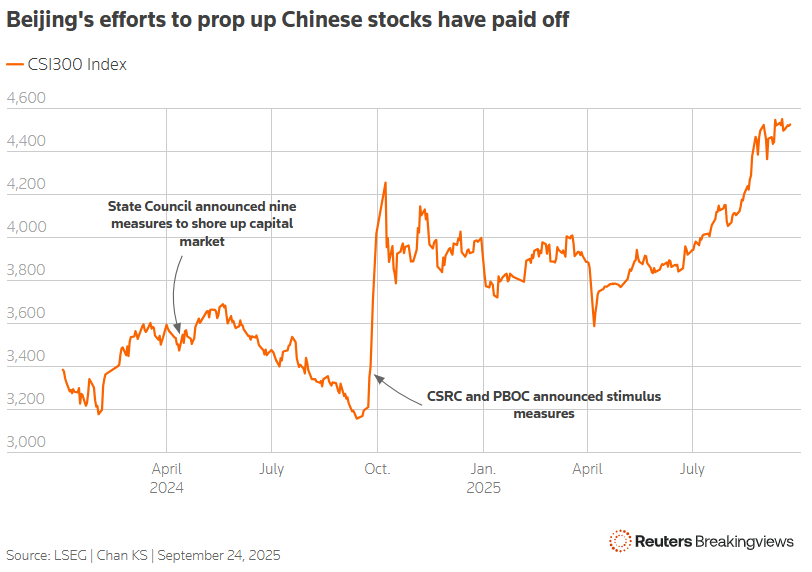

Beijing’s policy-driven stock market surge has lifted A-share values 52% over the past 12 months. Equities now serve as a key alternative for savings amid the ongoing weakness in the real-estate market, which has seen investment fall 12.9% (7).

References

Comments